Last month, we hosted a webinar on 'How to stand out in a crowded market' , for sellers to take home actionable insights as they consider their M&A strategy. Here are the key takeaways including the webinar recording.

The Knowledge Economy is in the eye of a perfect storm

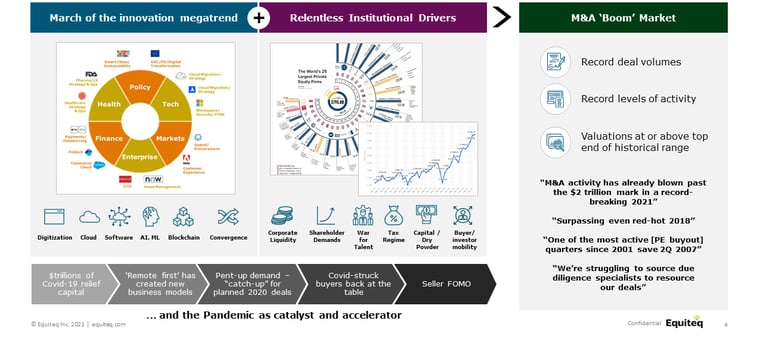

Fundamental drivers of transactions have prevailed and propelled by the pandemic, which has resulted in existing sector trends accelerating and becoming more compelling. These trends include digitization, cloud, blockchain and the convergence of sectors.

2021, so far, is seeing record deal volumes, record levels of activity and valuations are at the top end of the historical range. However, as with any storm comes dark clouds that sellers should be wary of including risk of tax raises, potential regulatory tightening and unknown consequences of exiting the pandemic.

Sellers have three key areas of focus to optimize outcomes

1. The appropriate selection of process and a detailed understanding of valuation and market dynamics

Buyers are knocking on several doors, which means that owners of businesses need to be smart in reacting and take the right advice to achieve optimal outcomes. It's even more important for owners to have a crystal clear idea of what those target outcomes are - for the business and personally.

2. The right positioning to the right buyers/investors in order to stand out

Navigating through a crowded market requires deep market understanding and global reach. To get buyer attention to your business, you must have a structured process supported by factual, complete, and clear documentation that conveys a compelling story of value drivers and synergies. We will always recommend to cast the net wide to ensure no stone is left unturned and maintain competitive tension, but this will only be successful if driven by deep knowledge of the buyer/investor landscape in the sector your business is in.

3. Best possible preparation to be agile and ‘ready to execute’ rapidly

If you are looking to sell your business in this environment, being "transaction-ready" has never been more important. This means answering yes to questions like: "Are your shareholders aligned?", "Do you have a transaction team in place with clear roles?" and "Are you prepared for due diligence and quick execution?". Being ready also means keeping your people incentivized towards a liquidity event and keeping communications and decisions with your transaction team focused on a liquidity event.

Watch the full webinar recording below to hear the complete discussion, where our panel of experts deep dive into each of the key highlights and expand on the three focus areas for sellers on how to navigate the current M&A market.

Want to find out more? Contact one of the featured speakers directly or contact one of our global offices.

Paul Dondos

Managing Director, Global Head of Buy-side, Market Intelligence and Strategic Advisory

London, UK

Greg Fincke

Managing Director, Co-head of Management Consulting & IT Services Sector, North America

Boston, USA

Jerome Glynn-Smith

Managing Director, Head of Management Consulting & IT Services Sector, Europe

London, UK

Sylvaine Masson

Director, Leading M&A transactions, growth and strategic advisory across Asia Pacific

Singapore