Last month, Equiteq's Managing Director and Co-Head of North America, Greg Fincke, was featured as a key speaker at the Collective 54 Inaugural Founders Summit in Fort Worth, Texas.

In this presentation, Greg shared Equiteq's perspective on key strategies when it comes to building a firm that attracts acquirers and the anatomy of a world-class exit.

Here are 5 key takeaways:

- Amid dynamic macroeconomic conditions, sectors within the knowledge economy have shown stability, with technology and consulting services experiencing heightened demand. Some key themes and observations from the market are that even after the onset of the pandemic, C-suite agendas shifted to upgrading technology infrastructure to develop better remote working capabilities, which led to an increased IT budget and strong demand for technology services.

- The global crisis chain has put immense pressure on management teams to protect their bottom line through enterprise-level optimization initiatives, ultimately creating a surge in demand for consulting services.

- Growing demand for business consulting and the rapid growth of technology vendors is attracting investment from both strategic buyers and financial sponsors alike, providing strong tailwinds for founders and owners to realize equity gains.

- Investor priorities mirror evolving market sentiments and will continue to shift in 2024. The recent market developments affect both strategic and financial sponsors alike, causing acquires to offset risk factors by adjusting investment criteria accordingly.

- Investors will continue to prioritize cash flows, shifting valuation perspectives from revenue to EBITDA multiples for the next 12-24 months.

The anatomy of a world-class exit

Equiteq has over 15 years of transactional expertise and a proven ability to drive above-market valuations. So how do you get to a successful exit?

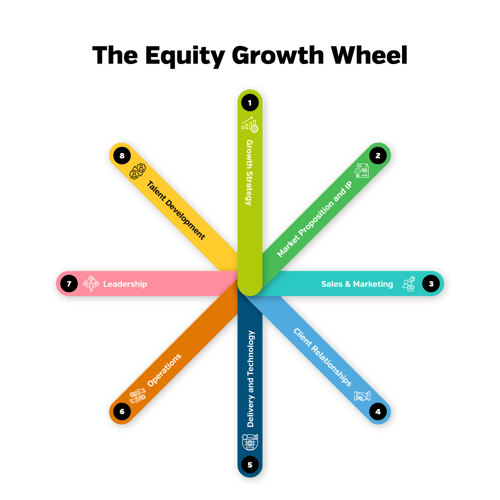

To ensure your business will attract the right buyers, at the right time, founders and owners need to look at its business operations the way a buyer would. To help our clients reach maximum valuation, Equiteq uses its proprietary eight-lever framework known as the Equity Growth Wheel, to advise clients and build a compelling, differentiated equity story.

Read more about the Equity Growth Wheel >>

If you'd like to discuss how to attract the right buyers, at the right time, get in touch with our Co-Head of North America, Greg Fincke, or one of our global team of experts.

Thank you to the Collective 54 team for hosting this successful event. Looking forward to your 2024 event!