Resilient M&A activity creates optimism in technology services sector

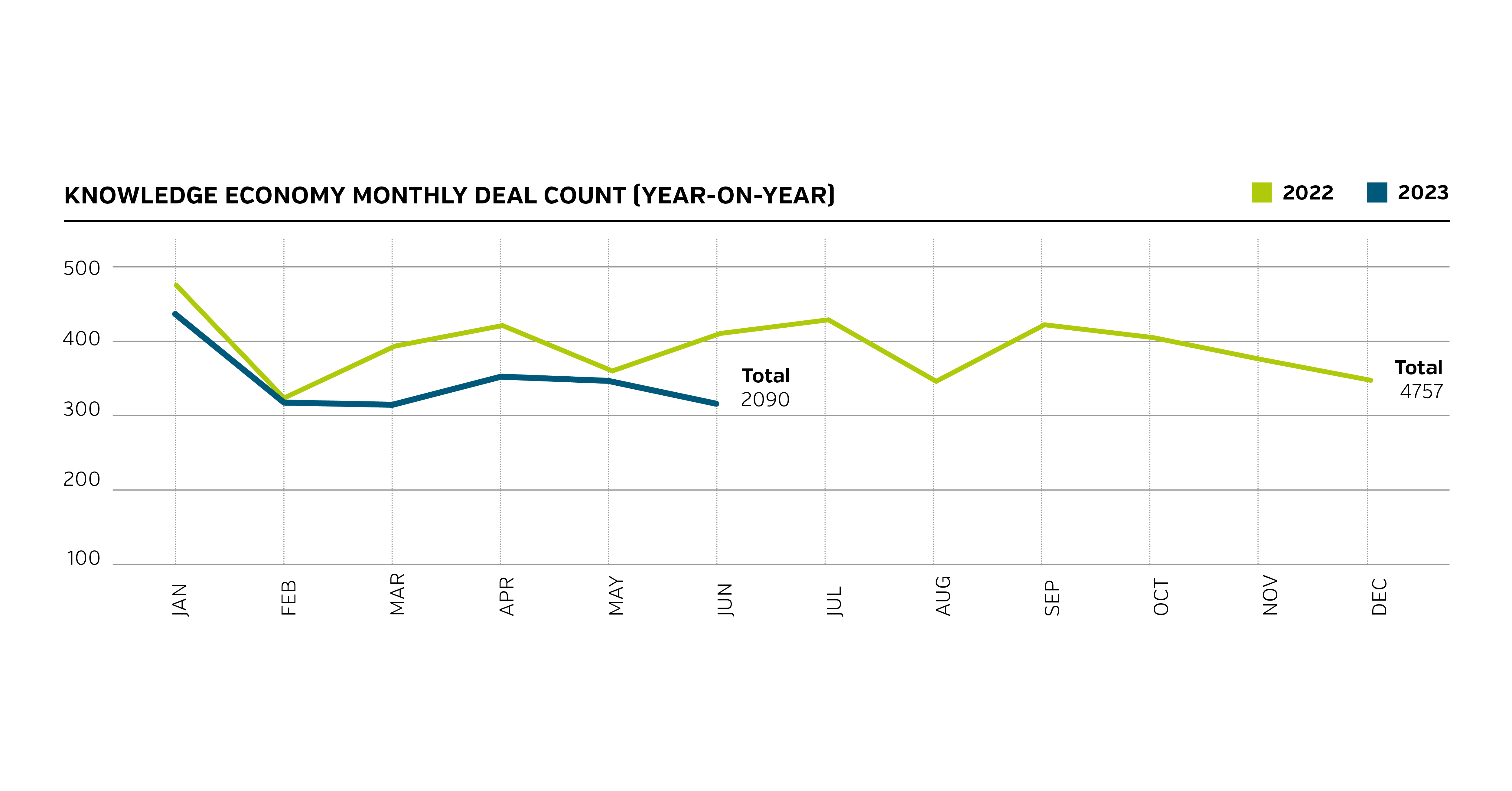

The first half of the year has shown resilience in M&A activity in the Knowledge Economy, despite disruption on multiple fronts. While overall deal flow has slowed since the past year’s highs, the need for digital transformation continues to drive acquisitions, with many buyers turning to mid-market opportunities. Equiteq anticipates a more active second half of the year, but the focus is expected to remain in the most resilient areas, focusing on tactical acquisitions.

In this blog, we break down the key trends in two key areas of the Knowledge Economy: IT services and Enterprise SaaS, plus spotlights on Procurement/Supply Chain IT and Public Cloud. You can see more on all these areas and the sector as a whole in Equiteq’s latest Technology Services M&A report.

IT Services

M&A activity remains robust with volumes steady and valuations growing. In particular, buyers are showing strong interest in innovative technologies such as AI and ML. Market turbulence has impacted the upper end of the valuations spectrum more than M&A appetites, although companies in data analytics, customer software development, and digital engineering continue to perform very strongly and attract healthy multiples. There has also been much more of an EBITDA-driven multiple from buyers, with revenue multiples not really being discussed.

Enterprise SaaS

While rising interest rates have dampened deal volumes year-on-year, activity remains robust, particularly among Private Equity firms that continue to be active buyers. In the second half of the year some opening up is expected in the market, with buyers looking to acquire mid-market firms that can add strategic differentiation – the capital-efficient scaling potential of recurring revenue makes SaaS particularly attractive. The market turbulence is putting pressure on sellers to be more prepared in terms of performance metrics, operating efficiency, and performance outlook to get deals over the line.

Procurement& Supply Chain IT

The disruption of recent years has fuelled demand for supply chain and procurement capabilities, creating opportunity and space for growth in the market. Particularly among strategic buyers there has been increasing need for supply chain consulting and technological expertise. Equiteq’s 2023 Buyers Report suggests this demand is here to stay, with 40% of buyers saying their interest in digital procurement or supply chain solutions was ‘high’ or ‘very high’. Given the sector’s fragmentation, it is also ripe for consolidation, with Equiteq being involved in a number of recent deals, including with Accenture, Kearney, and YCP Holdings.

Public Cloud

The demand for cloud services remains high, with digital transformation a non-discretionary spend and a fundamental driver of M&A activity. Equiteq’s Buyer Report suggests this will continue, with two-thirds of buyers saying they had a ‘high’ or ‘very high’ interest in Public Cloud services in the next 2-3 years. Notably, there is growing interest from management and strategy consulting firms in building Cloud capabilities, with firms looking to be able to implement the Cloud transformation projects they recommend.

Preparation, preparation, preparation – the key to transaction success in the current market

The increased expense of financing deals has created a more cautious and challenging environment, putting a premium on those sellers who are well-prepared for sale. It is therefore crucial that those thinking about selling put themselves in the best possible position by:

- Putting in place the team, with the right incentives to deliver the exit

- Preparing a clear and compelling equity story around their offering differentiation

- Building relationships in the market ahead of time

- Prioritizing strong customer satisfaction and delivery of numbers to a growth budget

For more on all aspects of the technology services sector, the state of the M&A market, and how best to position yourself for a transaction don’t miss Equiteq’s latest Technology Services M&A report.