Deals for life science professional services firms continue at pace, according to a new report. But EBITDA for management consultancies in the sector appears to be falling – suggesting enthusiasm may cool among private equity investors in the coming year.

As the global economy enters recession, the fundamentals of the healthcare market, and the consultants serving it, is considered a rare certainty – especially in the wake of the pandemic. As a result, M&A within the life sciences sector continues to be very active for consulting and technology companies.

Even amid the inflation and market turbulence of the second half of 2022, this has led to a number of attention-grabbing acquisitions. AmeriesourceBergen’s purchase of PharamaLex, for example, concluded for $1.3 billion in September 2022, and there have been plenty of other trade deals, as well as many companies attracting investment from private equity.

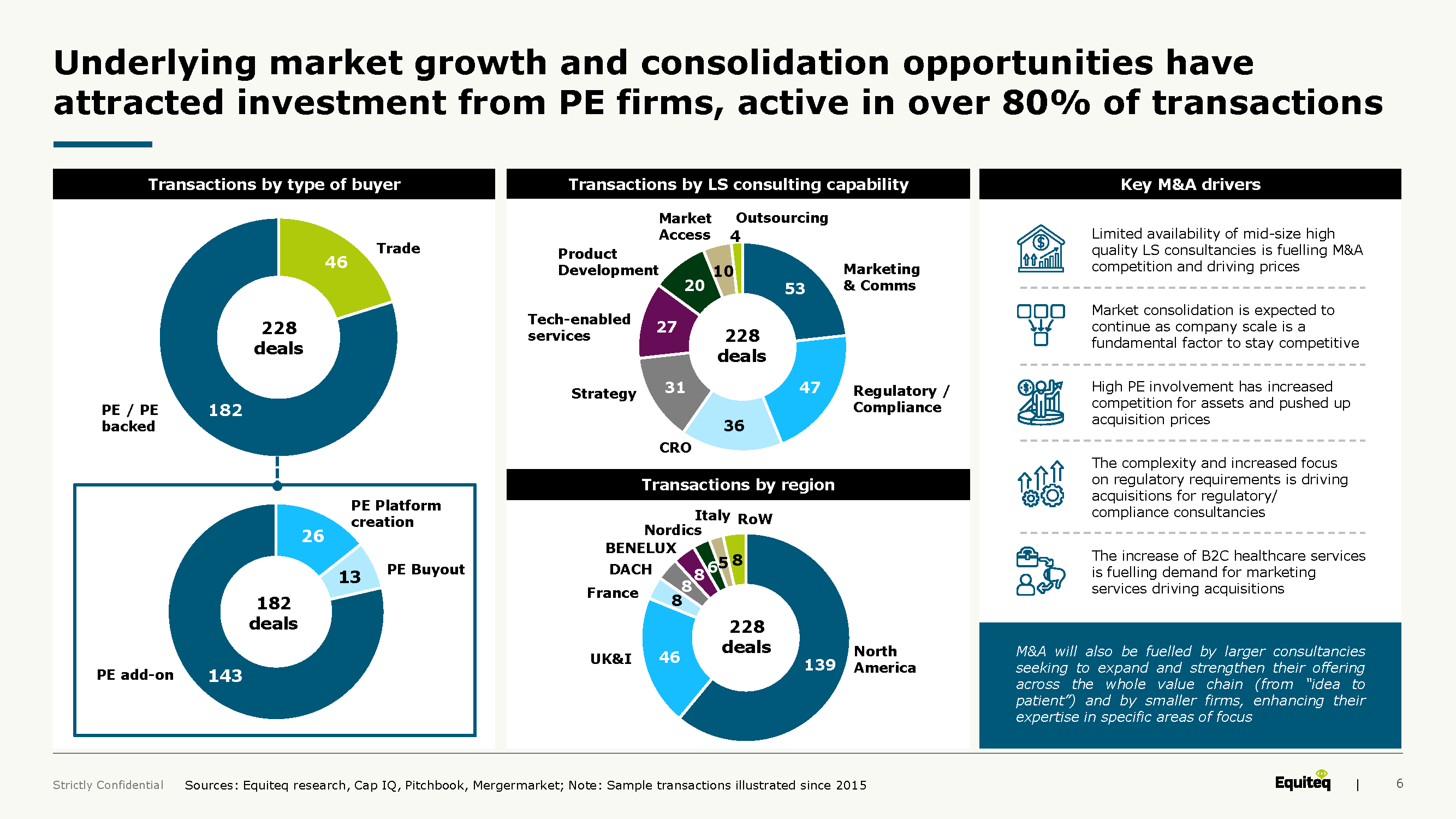

To understand the driving forces behind these deals, and where the market is currently headed, Equiteq has released its annual ‘Life Sciences Consulting M&A Report’. According to the analysts, the majority of the 228 deals in the sector this year have been backed by private equity investors – while only 46 have come from in-market trade.

Within the 182 private equity related deals, the largest part were add-ons for existing portfolios. A smaller 26 were ‘platform creation’ as firms sought to start such portfolios, while 13 were backing management buyouts. As private equity firms look to markets which will give them the best chance of quickly adding value in a difficult economy, this shows investors are being pulled into life sciences consulting, even as prices inflate.

Limited availability of mid-size high quality life sciences consultancies is boosting M&A competition, and driving prices up. However, complexity and increased focus on regulatory requirements in life sciences means investors are confident of consultancies enjoying keen demand in the coming months – driving 47 deals for compliance consultancies – while the boom in B2C healthcare services will similarly boost demand for marketing services; which involved 53 deals.

The UK and Ireland made up for the second largest chunk of deals, at 46. It was only surpassed by the world’s largest regional consulting market – North America – at 139 deals.

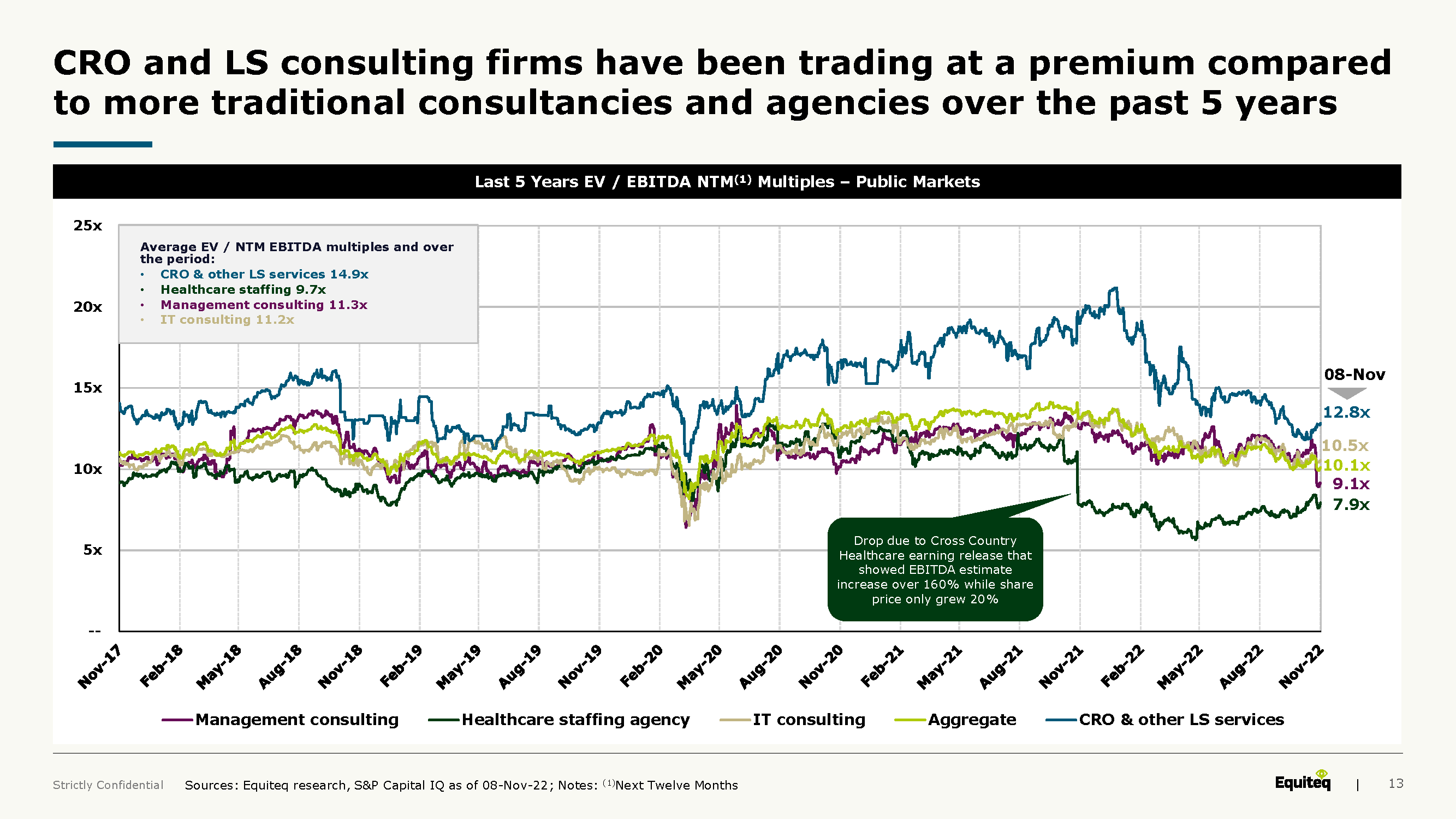

Looking ahead, however, the potential for earnings before interest, taxes, depreciation, and amortization (EBITDA) varies between different kinds of professional services firms. Equiteq’s report suggests that while consulting firms in particular have enjoyed heightened EBITDA, this may be dropping – and with it, M&A demand for management consultants may fall.

EBITDA for CRO and life science services is still trending upward, hitting 12.8x at the end of 2022. But having been level just one month earlier, EBITDA for management consulting fell to 9.1x in November – the largest drop in 2022 of any segment Equiteq was monitoring in life sciences professional services M&A. While the segment still displays the potential for very healthy returns, then, enthusiasm may well cool slightly for management consulting deals in the coming months.