A global squeeze on software talent is driving price inflation and creating fertile ground for an explosion in low code/no code alternatives in the custom software development (CSD) market as reported in our 2023 Outsourced Custom Software Development Report.

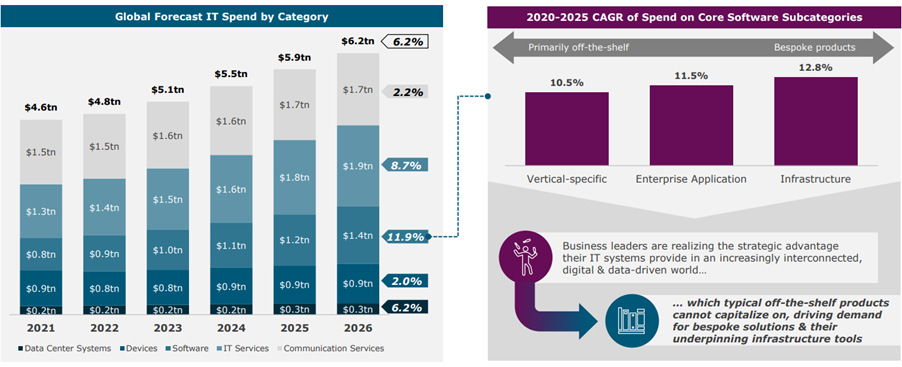

CSD is the process of designing, creating, deploying, and maintaining software for a specific set of users, functions or organizations. Currently worth $93bn, the CSD market is expected to be valued at $120bn by 2026, a CAGR of 8.5% from 2021. This fits into a pattern of rising IT spend more broadly, which is forecast to reach $6.2tn by 2026. An increasing proportion of this spend is going towards bespoke software, with the global spend on software forecast to rise from $0.9tn in 2021 to $1.5tn in 2026, a more than 65% rise.

Our CSD report suggests that this growth in software investment will outstrip the supply of talent, with the number of software developers only rising by around 20%, from 25.5m to 31.3m. When surveyed, 61% of CIOs regarded resourcing as their most significant work issue over the next eighteen months.

That pressure is creating opportunities for low code/no code platforms, which can deliver at lower cost and need less ongoing maintenance than high code alternatives. As well as cost savings, low cost/no code also has a reduced development time – allowing for a faster response to market conditions – and allows users greater control over the development process, minimizing the risks from miscommunication.

As a result, spend on low cost/no code is expected to rise from $23bn in 2022 to $60bn in 2026, a CAGR of 27.8%. This opportunity has led to a proliferation of low code/no code vendors and increasing buy-in from established players, including deal announcements such as Microsoft’s acquisition of Softomotive and Salesforce’s acquisition of Tableau.

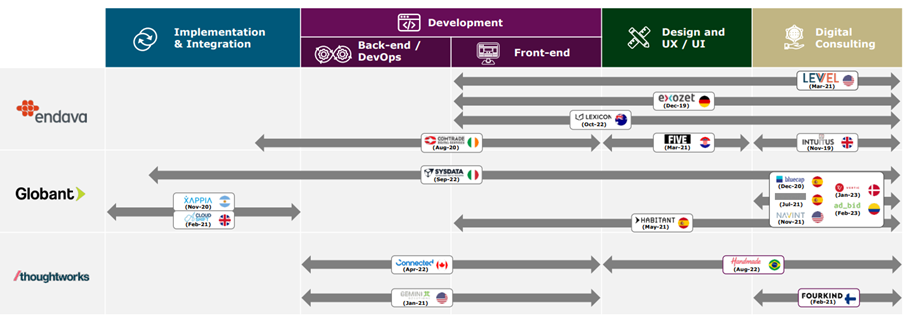

Opportunities remain, however, for more established CSD providers to offer value-add strategic services, delivering more complex IT and helping companies navigate an increasingly complex macroeconomic landscape. Our report suggests that many CSD providers are already taking advantage of this through targeted acquisitions in the digital consulting space.

This shift towards strategic services puts CSD companies into competition with global consulting and R&D as well as their traditional competitors in design and regional IT. It is therefore more important than ever that CSD companies can offer an integrated digital service alongside their legacy delivery model, building capabilities to compete in an increasingly crowded marketplace.

For more on what these changes mean for you, as well as further insights on the state of the CSD market, read the full Equiteq Outsourced Custom Software Development report here.

To request to speak to an expert from our global team, email us at info@equiteq.com.