Healthcare and Life Sciences Consulting Global M&A Report 2018

Our review of deal flow in the healthcare and life sciences consulting space shows rising demand from cash-rich strategic and financial buyers for larger acquisition opportunities

By Ramone Param, Director

Published today, Equiteq’s healthcare and life sciences consulting global M&A report provides exclusive acquisition and valuation insights for consulting firm owners considering a sale. The data reviews M&A, investor and equity market activity in 2017, as well as over the last ten-years. Our unique insights are informed by our regular detailed conversations with the leading serial acquirers of healthcare and life sciences consulting businesses. The following is a brief overview of the key themes from the report, the full version of which can be found here.

Healthcare M&A activity at a glance

- 371 completed deals in 2017, down 12% year-on-year

- Median deal value of $21m, up 14% year-on-year

- 24% of deals were cross-border

- The Equiteq Healthcare Consulting Share Price Index rose 28%, while the S&P 500 gained 18%

There were large variations in deal flow among healthcare consulting segments, with stronger activity occurring in spaces like data & analytics and strategy consulting to life sciences companies. The number of completed deals fell, but the median size of transaction rose substantially, indicating that buyers were focused on a smaller number of larger deals.

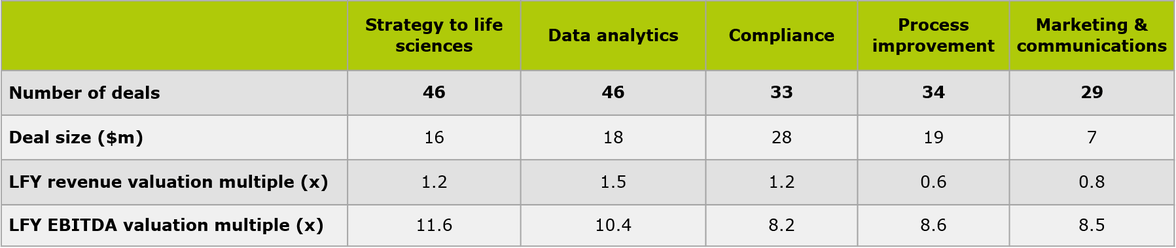

M&A transaction statistics by selected healthcare consulting segments (2017)

Note: Deal sizes and valuation multiples are median figures for the respective segments. 183 transactions involved the acquisitions of healthcare consulting firms that did not focus on the above five segments.

Premiums being paid for market access consulting services to life sciences

As outlined in our recent life sciences consulting M&A review, acquisition demand for life sciences strategy consultancies is exceptionally high. Recent landmark acquisitions by both strategic and financial buyers were struck at premium valuation levels. One area within life sciences strategy consulting in which buyers are particularly keen to augment their capabilities through acquisition is market access. There are a variety of tailwinds fueling demand for expertise of market access consultancies who are well-positioned at the intersection of strategy, science and analytics.

Demand for management consulting services for healthcare providers

The report revealed strong demand for management consulting businesses that serve healthcare providers, as discussed in our recent article on this space. Across the globe, a confluence of demographic, economic, regulatory and technological drivers are forcing providers to improve care standards and enable efficiencies.

One of these drivers is the continued shift from fee-for-service to value-based care models of healthcare reimbursement in the US and Europe. Payer driven value-based purchasing is driving a need for providers and life sciences to improve the provision of cost savings from new therapies. Patients are also becoming more discerning consumers of healthcare, with a desire to become more involved in the treatment process. These changes in care models and patient expectations are driving demand from providers for advisory solutions regarding investments in technologies and processes that enhance services and reduce costs.

Digital advancements and disruption in healthcare

As outlined in our 2018 Knowledge Economy M&A report, across the globe knowledge-intensive services firms are benefiting from the potential to help clients realize competitive advantages from using rapidly evolving technologies. These include connected devices embedded with the latest artificial intelligence and advanced data analytics solutions. In the healthcare sector, these new digital technologies can offer exciting ways for providers, payers and life-sciences companies to gain competitive advantages. A major acquisition of a technology-enabled consulting player in 2017 was by UnitedHealth’s Optum, which acquired Advisory Board’s healthcare business for $1.3bn.

A strong start to 2018 and positive outlook ahead

Demand for acquisitions of knowledge-intensive services firms focused on serving healthcare providers, payers and life-sciences companies continues to be strong in 2018. The team expects a continued focus on acquiring capabilities related to the latest digital technologies disrupting the healthcare space. A robust global economic outlook and ongoing changes to the regulatory environment in the US and in Europe may also drive growth in M&A.

Read the full report for unparalleled M&A and equity market trends and insights in the healthcare and life sciences industry, including tips on how to interpret these trends as an owner of a business in the knowledge economy considering a sale.

Equiteq has executed seven healthcare consulting transactions and over 15 strategic advisory engagements in the sector. More than 30 of our bankers and consultants have specific healthcare and/or life sciences advisory and/or M&A deal experience.