Trade buyers (also known as strategic buyers) are companies that buy other operating companies as part of their growth program and to fulfil other corporate objectives. As the most active category of buyers in the market, it is critical to understand how trade buyers think and behave as you build your business for eventual sale.

The primary driver for them is the overwhelming need for growth. All professional services firms require growth, and stated another way, protection against shrinkage and loss of relevance. This is true not only for large publicly traded firms that have to explain their financial results every quarter to investors, but also for smaller firms that compete with them for specific business. If you are building your own firm, you know how difficult it is to grow through hiring, service line expansion and finding new clients (organic growth). As firms become larger, the need to supplement organic growth by acquiring revenue becomes more and more acute.

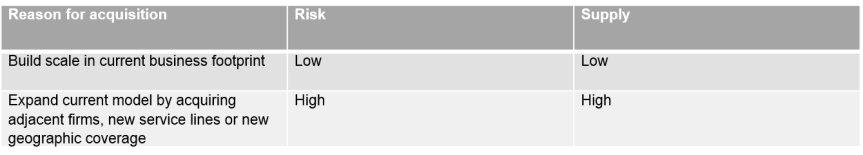

There are two primary reasons why trade buyers make acquisitions:

- To build scale in the current business footprint (service line, geography) through the acquisition of similar firms which are rapidly integrated

- To expand the current model by acquiring adjacent firms, new service lines or new geographic coverage

The most active trade buyers are the household names that you might expect. However, do not make the mistake of casting the net too narrowly when thinking about who might be a buyer of your business. As the business world seeks solutions and bundled services from their suppliers, we are seeing more and more companies who do not traditionally offer consulting services look to acquire businesses that can help them provide more of a solution-based offering to their clients.

Take the example of a multi-national equipment manufacturer client of ours. They are looking to buy consulting businesses in several of their product lines, such as in workplace safety consulting, so they can bundle that service as part of a broader solution to larger clients.

As you consider your options for selling your firm, it is critical to understand your position relative to larger competitors in your space and adjacent firms that might see your services and clients as additive to their current offerings. Even if a potential sale is years away, it is never too early to understand who might be interested in your firm and what you might do – and not do – to use that knowledge to your advantage.

NB: The term ‘trade buyer’ refers to those who acquire for strategic purposes and includes in it our definition of consulting and corporate buyers.